3 costly mistakes baby boomers make with Medicare

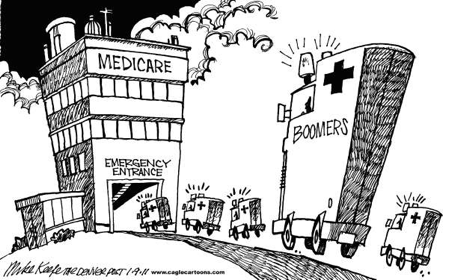

(BPT) – Each day, thousands of people in the U.S. turn 65, and they’re faced with making choices about the Medicare program. Unfortunately, many people’s missteps mean they end up paying too much for healthcare coverage.

“A study published by Health Affairs, a peer-reviewed healthcare journal, estimated that more than 20 percent of people are paying at least $500 too much each year for their prescription drug Part D plans,” says Tricia Blazier, director of the Allsup Medicare Advisor.

Blazier says the study found that only five percent of Medicare beneficiaries chose the lowest cost Part D plan. Researchers also found that many people overpaid for a Medicare plan, missing out on other plans that would better meet their needs at less cost.

“You may have 20 or more plans to choose from with different features. These plans come with a wide range of costs, and the highest premiums are sometimes double the lowest.”

If you’re a baby boomer, here are three costly and common mistakes you might be making with your Medicare coverage.

You make hasty choices because you’re employed. “Often people automatically signed up for Medicare at 65 even if they were still working,” says Blazier. “But health benefits are becoming more complicated and this is less common.”

For example, more baby boomers are using high-deductible health plans (HDHP), which carry restrictions for people who want to use Medicare, too. There also are penalties for improperly delaying enrollment in certain parts of Medicare.

“Making these choices quickly can carry some unexpected costs,” says Blazier. “You don’t want to miss your first-time enrollment period without taking a closer look.”

You sign up for traditional Medicare for convenience. Traditional Medicare includes Part A, hospital services, and Part B, medical services. Many first-time enrollees also buy a prescription drug Part D plan and supplemental insurance, or Medigap. “You may think it’s easier to just enroll in the traditional package of Medicare benefits, but your costs can really add up.”

Nearly 16 million people enrolled in Medicare Advantage plans in 2014, an increase of almost 20 percent since 2012, according to data provided by the Kaiser Family Foundation.

Medicare Advantage plans offer an alternative to traditional Medicare. They can replace several plans with one form of healthcare coverage. “You can see some incredible cost savings by taking a look at Medicare Advantage plans,” says Blazier. You can find services and resources to compare Medicare Advantage and traditional Medicare plans at websites such as Medicare.Allsup.com.

You look for shortcuts by choosing a family member or friend’s Medicare plan. “It’s easy to enroll in Medicare,” says Blazier. “Maybe a little too easy.” But it’s not uncommon to have buyer’s remorse once the coverage begins and it’s clearer how much or how little the plan covers.

Some of the biggest mistakes happen when individuals turn 65 and enroll in Medicare for the first time. It can be challenging to find accurate, up-to-date information in order to make fair comparisons among all the options. But doing some research, especially with the help of a Medicare specialist, can mean big savings that more than makes up for the extra effort.

Experienced Allsup Medicare specialists help individuals, family members and caregivers with Medicare plan selection at (866) 521-7655. Find more information at Medicare.Allsup.com or click here.